tax identity theft occur

A business that doesnt exist. Tax season will open on Tuesday January 19.

What Do Identity Thieves Look For Protect Your Data Debt Com

Tax-related identity theft occurs when someone else files a tax return using your Social Security Number SSN.

. Be Safe from Fraudulent Transactions Loans. What to do when someone steals your identity and tax refund Get in touch with the IRS at 800-908-4490. Tax-related such as.

Ad Your Digital and Financial Identity Face Constant Risks. Financial identity theft is a type of identity theft that involves the unauthorized use of someones personal information to obtain money goods or services. You Need Constant Protection.

They have the refund sent to their own bank. Join a Plan Today Starting 899. People often discover tax identity theft.

The victim may be unaware. A tax identity theft happens when an imposter uses your personal information in order to file false fraudulent tax returns. Most criminals who commit tax fraud steal their victims tax benefits and refunds so they often execute attacks.

Your Protection Is Always On With Real People Ready 247 To Help When You Need It. This statement is an attempt to fool the IRS into. If you suspect you are a victim of tax identity theft here are some steps to follow.

Tax related identity theft occurs in a variety of ways like losing a wallet or purse lost or stolen mail and discarded documents left un-shredded. Identity Theft happens to 1 Out of 4. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund.

In some cases thieves do this in order to claim a fraudulent tax refund. With identity theft and cybercrime on the rise most people are familiar with the term. Dont Be That One.

Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. This day also marks one of the busiest times of year for identity thieves looking to cash in by filing false tax returns. The most common tax identity theft scams are when someone else claims to be.

Tax identity theft occurs when someone files a tax return using your Social Security Number SSN. Ad Make the Right Choice With the Help Of Our Listings. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Tax identity theft involves the illicit filing of tax returns using stolen PII. But perhaps one of the most common.

Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. The IRS recommends you take the following steps if you feel one of the above has occurred that may have resulted in your identity being compromised. Identity theft occurs when someone obtains your personal or financial information and uses it fraudulently without your permission.

Our Identity Verification Authentication Solution Helps Prevent Fraudulent Attempts. Tax identity theft occurs when someone takes your personal information and uses it to file a fake return to get a refund from the IRS. Tax-related identity theft occurs when a thief uses someones stolen Social Security number to file a tax return and claim a fraudulent refund.

Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name and collect. What Is Tax Identity Theft. ID theft through a tax professional.

Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that. Place a fraud alert on your credit file with one of the three major credit bureaus. A corporation that is not.

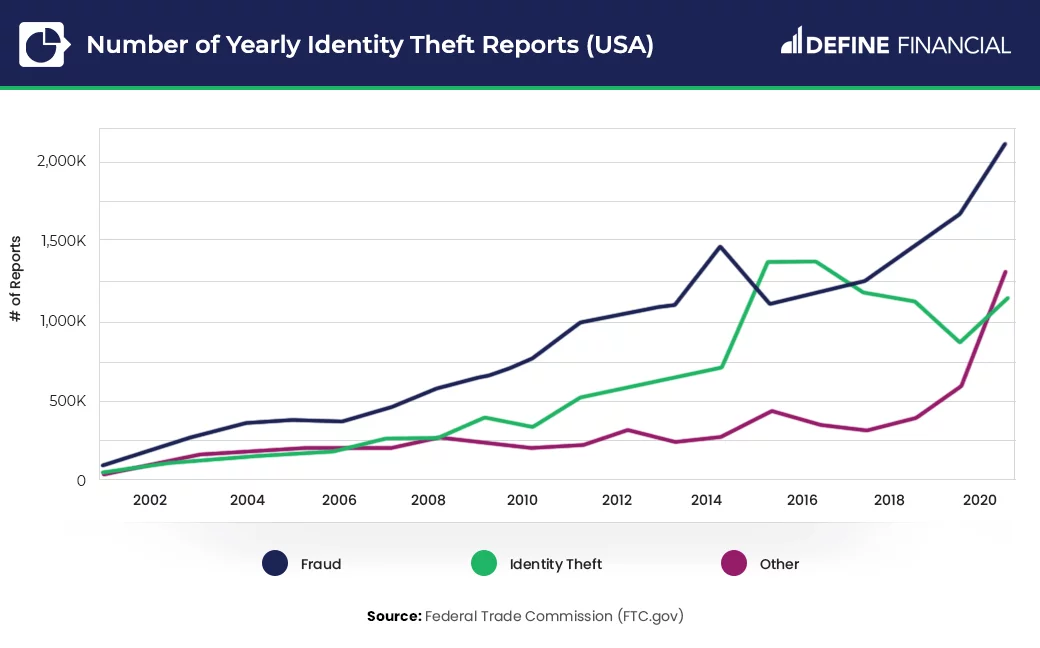

Ad Have Full Control of Your Credit Activity. Ad We Have The Premiere Solutions To Help Protect Your Company From Fraud Threats. In fact its an occurrence that has been growing since the early 2000s.

This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. The identity thief will use a. Fill out an IRS Identity Theft Affidavit sworn statement found here.

An individual who has died. Tax ID theft occurs when someone uses a stolen Social Security number SSN to file a fraudulent federal tax return and get money in the form of a refund from the IRS. A taxpayer with no income.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. For example people who have a. Respond immediately to any IRS.

The IRS may flag the return if it looks suspicious. Compare ID Theft Protection Services. Identity theft may be.

Identity Theft And Fraud Protection How To Stay Safe

50 Identity Theft Credit Card Fraud Statistics 2022

Tax Identity Theft American Family Insurance

50 Identity Theft Credit Card Fraud Statistics 2022

How Does Identity Theft Happen Equifax

50 Identity Theft Credit Card Fraud Statistics 2022

How Common Is Tax Identity Theft Experian

How Does Identity Theft Happen Equifax Canada

Types Of Identity Theft Equifax

Learn About Identity Theft And What To Do If You Become A Victim

What Is Identity Theft Definition From Searchsecurity

Types Of Identity Theft And Fraud Experian

Types Of Identity Theft Equifax

What Is Digital Identity Theft Bitdefender Cyberpedia

Where Does Identity Theft Happen Most Bankrate

What Is Tax Related Identity Theft And How Can You Recover From It

How To Protect Yourself From Identity Theft Money

Tax Identity Theft American Family Insurance

25 Warning Signs Of Identity Theft Don T Fall Victim In 2022 Aura